CEOs, Board Members and Elected Officials can be held personally-and in some cases criminally-liable for harm caused by cyber attacks. Legally Assured Cybersecurity isn’t just best practice—it’s your legal shield. Unlike standard IT consulting, which comes “as is” with zero accountability, Legally Assured Cybersecurity delivers independent legal validation that your organization fully meets regulatory and tort liability standards. It’s not just protection—it’s proof of due dilligence and due care.

Take Control With Legally Assured Cybersecurity

CEOs ◦ Boards ◦ Organizations

Legally Assured Cybersecurity for Lawyers

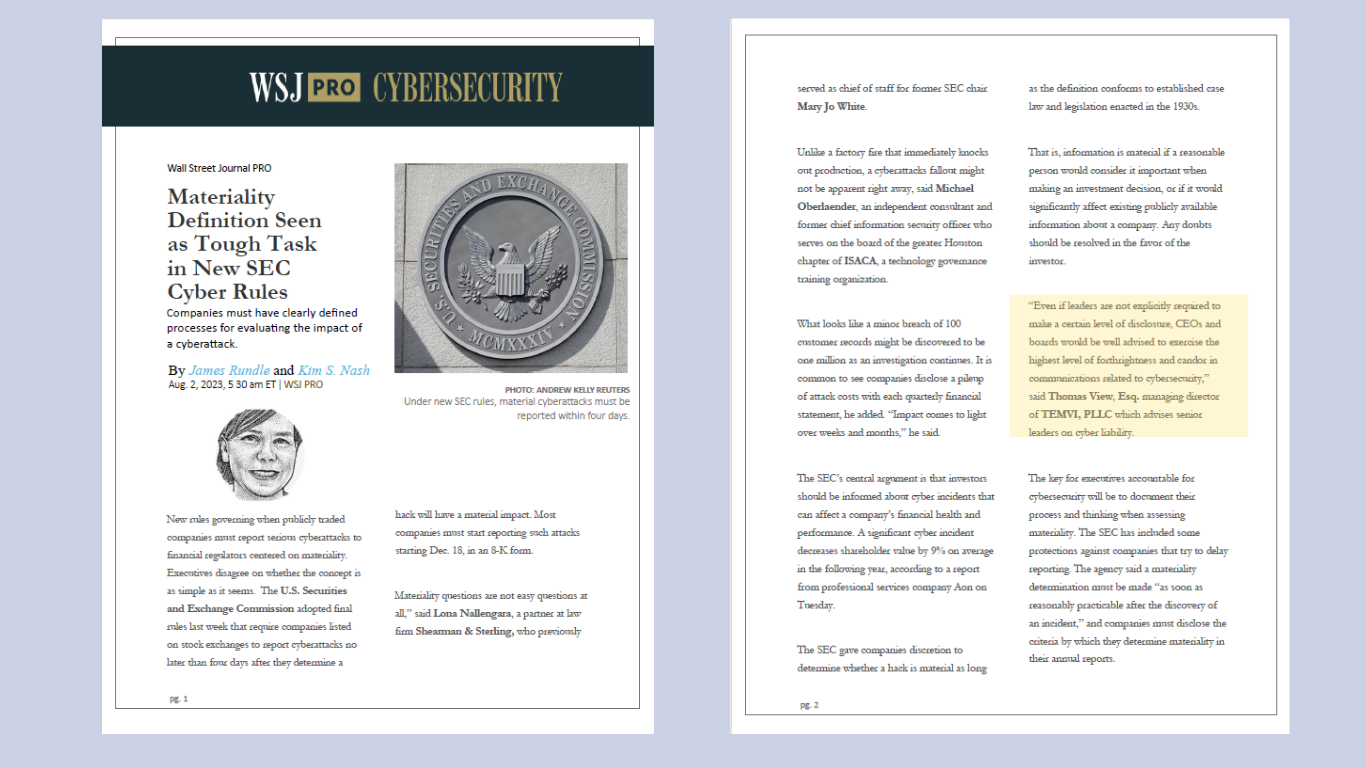

TEMVI in the News

CEOs--TEMVI U Registration

CISOs TEMVI U Registration

FOR LAWYERS

Seats are limited—reserve your spot today.

Lawyers

About Legally Assured Cybersecurity

What is Legally Assured Cybersecurity?

TEMVI University Registration

Our Leadership Team

Thomas View, Esq. JD

Managing Director

Mr. View, managing director and co-founder of TEMVI, is an enterprise technology attorney whose expertise in information security and enterprise IT drives TEMVI’s service model. He has guided CEOs and boards in assessing and overseeing cybersecurity posture and previously served as General Counsel and COO of a national cybersecurity firm conducting assessments for Fortune 500 companies and government entities, including Xerox, Conduent, the IRS, and multiple states. Mr. View earned his J.D. from Georgetown University Law Center and his B.A. from Oberlin College.

Donald Temple, Esq. LLM

Managing Director

Mr. Temple, managing director at TEMVI, brings decades of civil litigation experience in complex trial and appellate matters before D.C. state and federal courts. A globally recognized litigator with major victories in U.S. District Courts, Courts of Appeals, and the Supreme Court, he guides TEMVI’s strategies for assessing litigation exposure and advising executives on mitigating liability. His rare insight into how courts view complex legal and fiduciary risks—especially in cybersecurity—shapes TEMVI’s approach. Mr. Temple holds a B.A. from Howard University, a J.D. from the University of Santa Clara, and an LL.M. in international and constitutional law from Georgetown University.

Bruce Hargrave, CISM

Managing Director

Mr. Hargrave is a Certified Information Systems Security Professional (CISSP) with extensive experience leading major cybersecurity initiatives as a partner at PricewaterhouseCoopers (PwC). He has led advisory teams serving clients such as Northrop Grumman, PwC, Toshiba, and the U.S. Nuclear Regulatory Commission. His cybersecurity expertise has protected critical infrastructure, defense supply chain, and regulatory environments. At TEMVI, Mr. Hargrave’s expertise informs our approach to cybersecurity assessments and testing, ensuring they meet the highest technical and regulatory standards while aligning with clients’ operational and strategic objectives. Mr Hargrave is a graduate of the University of Virginia.

Susan D Biglow, Esq.

General Counsel

Susan Biglow, Esq., is a seasoned attorney with extensive experience advising corporate leaders on regulatory compliance, risk management, and internal investigations. Her legal practice has spanned government oversight, corporate governance, and data protection. At TEMVI, Ms. Biglow’s expertise supports the legal frameworks that guide our cybersecurity services, particularly in regulated industries. She brings a strategic perspective to minimizing legal exposure, ensuring our clients’ cybersecurity posture aligns with evolving laws, fiduciary duties, and enforcement trends. Ms. Biglow is a graduate of American University, Washington College of Law

Doug Grayson, CPA

Chief Financial Officer

Doug Grayson, CPA, is CFO of TEMVI and brings extensive experience from his background at the World Bank Group, specifically the International Finance Corporation (IFC). At IFC, Grayson served as Lead and Principal Housing Finance Specialist for over a decade, focusing on housing finance initiatives in the US and Latin America. His career also includes senior finance roles such as CFO at Connaught Real Estate Finance and CIG International, as well as board service with Independence Federal Savings. Grayson is recognized for his expertise in impact investment and financial leadership. Mr. Grayson has a BA in Economics from Morehouse College.

Dr. Jenice L. View, PhD,

Chief Education Officer

In her leadership role at TEMVI, Dr. View oversees cybersecurity strategy and governance for K–12 and postsecondary institutions, helping schools strengthen their capacity to protect sensitive data, secure digital learning environments, and comply with evolving regulatory standards. Dr. View brings a multidisciplinary approach to cybersecurity in education. Her expertise in critical pedagogy, institutional development, and educator training supports TEMVI’s mission to align cyber governance with educational equity, student safety, and digital innovation. Dr View holds a PhD from the Union Institute, an MPA from Princeton University, and a BA in Economics and International Relations from Syracuse University,

Dr. Timothy McKnight, MD

Medical Director of Cybersecurity

Dr. McKnight leads the development and implementation of TEMVI’s cybersecurity policies and programs for healthcare providers and systems. A physician and experienced healthcare executive, Dr. McKnight brings deep insight into the complex challenges facing providers, including patient outcomes, reimbursement, brand reputation, insurance coverage, and risks related to fraud, waste, and abuse. Her leadership ensures TEMVI’s services are grounded in real-world healthcare priorities, aligning cybersecurity strategy with clinical and operational goals. Dr. McKnight Has an MD from Tufts University, an MS from the University of Texas and a BA from Brown University.

Leah Smythe, BA, MA,

Director of Communications

Ms. Smythe is Director of Communications at TEMVI, where they lead strategic messaging, public engagement, and brand development across the organization’s cybersecurity and education initiatives. With deep experience in media relations, crisis communication, and digital strategy, they shape narratives that build trust among educators, policymakers, and institutional leaders. Ms. Smythe holds a Master’s degree in Strategic Communications and a BA in Political Science, and has previously directed campaigns at the intersection of public interest, technology, and education. At TEMVI, they ensure that complex issues—like cybersecurity readiness, data governance, and institutional integrity—are communicated clearly and credibly to diverse audiences.

TEMVI uses Legally Assured Cyber Security to safeguard your cyber-threat exposure. We aim to be the silent shield behind your boldest dreams.

In protecting your purpose, we help uphold the fragile miracle of our information-based civilization.

Humanity’s genius lies in language, in our power to shape ideas into action, to join hands through words and build the unseen.

We aspire to be the keeper of that trust—defending confidential information, visions and the connections that let teams soar.

Our Services

Businesses and Government Contractors

Federal, State and Municipal Agencies

.

Educational Institutions

Non- Profit Organizations

What Our Clients Say – The Confidence That Comes With Legal Clarity

Using TEMVI's Hybrid Method℠--where legal, IT, and business groups worked as a team to analyze the American Red Cross IT agreements--was very effective….It resulted in the identification of performance gaps in some contracts, which allowed us to renegotiate multi-million dollar contractual improvements for our enterprise IT systems.”

Mary Elcano Esq.,General Counsel, American Red Cross

TEMVI’s legally assured cybersecurity model enabled full recovery of the disputed amount—plus interest and legal fees—in a case against the FAA after a social engineering attack. The outcome demonstrated that our client had met its legal duties of due diligence and due care, strengthening both its posture and its position in litigation.

Johnny Brooks,CEO, Brooks & Associates, CPAsPrime Contractor FAA--$56M Financial Management USA

With TEMVI’s guidance, we ensured our information security and regulatory compliance aligned with federal and state requirements across the U.S., strengthening our posture, reducing risk exposure, and meeting all relevant legal, operational, and industry standards—demonstrating our commitment to due diligence and responsible governance.

Fuad RezaVice President of Operations--Canada Pooch Canada

TEMVI led our FISMA compliance initiative following a sophisticated attack linked to a state-sponsored threat actor associated with a hostile nation’s nuclear weapons program. Their leadership ensured our response met federal standards, mitigated legal exposure, and restored operational integrity—protecting both our mission and reputation.

CEO-Federal Government Contractor

The team at TEMVI gave us the confidence we needed to strengthen our cybersecurity governance. Their insight into cyber controls and officer & board accountability helped us manage risk, improve transparency, and ensure we were meeting regulatory expectations. They’re a trusted partner in navigating today’s cyber landscape

Janice BrooksNational Chair National Congress of Black Women

TEMVI guided us through several high-risk information security incidents that threatened our operational continuity and reputation. Their integrated legal and technical approach helped us contain the damage, coordinate effective response, and meet our legal obligations—ultimately preserving our viability and restoring stakeholder confidence.

Stephen Bowman,CEO and Founder Peregrine Senior Living

Upon completion of the Quiz, you will receive a diagnostic legal opinion on your organization’s cybersecurity posture.

In response to your answers to the questions posed, we will provide you with a qualified diagnostic legal opinion related to your organization's cybersecurity posture.

This qualified opinion is provided solely for diagnostic and informational purposes, based on the information you provide in the quiz. It is intended to give you a general sense of your organization’s cybersecurity posture.

This opinion does not constitute legal advice, a guarantee of security, or operational assurance against negligence, loss, or other risks. It should not be relied upon as a substitute for comprehensive cybersecurity assessments, ongoing risk management, or professional legal counsel.

Such guidance can only be provided by entering into an attorney-client relationship with TEMVI.